Blue J Legal had a small booth at the American Association of Law Libraries conference in Washington, DC this summer. Yet…  they had one of the most impressive new offerings in the exhibit hall. Tax Foresight can predict the likely outcome of a tax controversy with at least 90 percent accuracy. The product uses AI – specifically “supervised machine learning” to analyze tax law and rulings and accurately predict the treatment of new tax situations.

they had one of the most impressive new offerings in the exhibit hall. Tax Foresight can predict the likely outcome of a tax controversy with at least 90 percent accuracy. The product uses AI – specifically “supervised machine learning” to analyze tax law and rulings and accurately predict the treatment of new tax situations.

One of the co-founders Benjamin Alarie, an associate dean at the University of Toronto was asked to judge the 2014 IBM Watson Challenge at the university. The event is a contest between students and startups to create “commercial implementations for the technology company’s AI-powered super-computer.”

Alarie was intrigued with the possibility of applying AI to tax law. He was joined by co-founders Brett Janssen and Anthony Niblett in creating the first prototype in 2015. They decided to design a product that was narrowly focused with deep analysis and highly useful to tax practitioners. Blue J’s development team includes law professors, lawyers, data scientists, management consultants, and engineers. In 2017 they launched Tax Foresight for Canadian market which was followed by Employment Foresight and HR Foresight. In 2018 they launched the US version of Tax Foresight.

Here is how it works

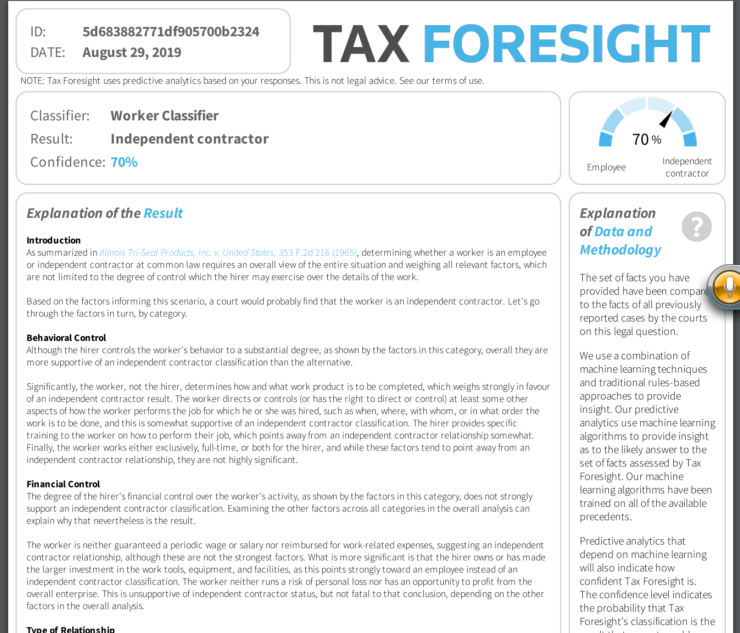

Input your scenario – Fill out a questionnaire identifying relevant facts of each your legal issue

Run the Analysis – AI analyses all the prior case law and rulings and makes prediction about your scenario.

Support Your Position – Tax Foresight will provide a custom prediction with explanations of the result and cite to the related precedent.

Document and Share – Download the Foresight Prediction reports and share it with colleagues and stakeholders.

Scenario Planning – Tax Foresight allow allows a lawyer to modify the facts and see the likely outcome in a variety of scenarios. Changing the variables allow a lawyer to see which factors are most likely to influence the outcome.

No Black Box Over the years they have expanded and modified the product based on lawyer feedback. Initially the product just provided the prediction without providing explanatory text. It is no surprise to me that tax lawyers wanted to know why they got that answer. So the company built out the features which expose the cases on which the outcome was based.

Supervised Machine Learning. How does Tax Foresight analyze past rulings and accurately predict the treatment of new tax situations? They are not “boiling the ocean.” They have selected 18 of the most challenging issues facing tax lawyers and accountants including such topics as determining whether an worker is an employee or a contractor. The product is built using a technique referred to supervised machine learning. They have lawyers who read all the documents. Lawyers and data scientist extract factors that go into a case law decision and create structured data. They use an algorithm to predict outcomes within 90% accuracy. Each issue has its own unique algorithm. The product continues to learn as new case law is continuously added and analyzed.

Tax Foresight Features include:

The analysis module allows you to find an outcome based on filters.

Navigate a feature is based on the statute and it brings you to the answer. They also include the last updating date.

Question answer module usually or has about 27 questions focused on the factors that are likely to drive the outcome. Lawyer can skip up to 3 questions and still get a result.

Scenario testing allows lawyers to interact with the Question Answer Module and model a best case scenario and worst case scenario..

Build a memo. The results appear in a memo format explaining the outcome.

Similar cases feature highlights faces that match your case on the most important factors.

Shareable Documents can be shared out internally downloaded into a configurable PDF there’s always an order trail you can add the firm name to the memo.

Topics – Tax Foresight covers 18 different topics including transfer pricing, worker classification, deductibility of business expenses.

Tax Foresight can be used for both controversy work and tax planning work. Right now they offer analysis of 18 complex tax issues and will add additional issues in the future. Since the word “prediction” has been used somewhat loosely in the legal market to describe products which provide historic trends, I am pleased that there is finally a product which shows us weighted and scored predictions of specific legal scenarios.

If your firm has a tax practice, I recommend giving Tax Foresight a look. You will also have the opportunity to see a sophisticated new approach to AI enabled legal research.

Pricing is based on the size of the tax group.