Today Lex Machina is announcing the release of a unique litigation analytics module on trade secrets. This is the second time in a year that Lex Machina has used machine learning to identify a unique and valuable subset of cases for with there is no “Nature of Suite” code in the Pacer ![]() system. Owen Byrd the company’s General Counsel and Chief Evangelist, provided me with a demo of the product. Byrd stated that ” trade secrets” analytics was the most requested addition to the platform. After taking an informal poll of some big law information professionals, I would describe their reaction as a collective “sign of relief.” The new module will include over 9,600 trade secrets cases pending in federal court since 2009, including cases filed under the 2016 Defense of Trade Secrets Act (DTSA). According to Byrd trade secrets has become as important as any other area of intellectual property in protecting a companies intellectual assets. Companies need to protect heir processes, formula’s and client lists as much as they need to protect their trademarks and patents. Byrd also pointed out that there is often an overlap between employment and trade secrets since issues often arise from the behavior of employees.

system. Owen Byrd the company’s General Counsel and Chief Evangelist, provided me with a demo of the product. Byrd stated that ” trade secrets” analytics was the most requested addition to the platform. After taking an informal poll of some big law information professionals, I would describe their reaction as a collective “sign of relief.” The new module will include over 9,600 trade secrets cases pending in federal court since 2009, including cases filed under the 2016 Defense of Trade Secrets Act (DTSA). According to Byrd trade secrets has become as important as any other area of intellectual property in protecting a companies intellectual assets. Companies need to protect heir processes, formula’s and client lists as much as they need to protect their trademarks and patents. Byrd also pointed out that there is often an overlap between employment and trade secrets since issues often arise from the behavior of employees.

Controversies such as trade secrets for which there is no nature of suit code in the Pacer system have been virtually invisible to researchers. It was virtually impossible to aggregate a specific data set of this type. Last year Lex Machina pioneered the use of natural language processing to cull a reliable subset of commercial cases – another high value controversy type which lacks an NOS code. They used NLP again to crawl all post 2009 pleadings in Pacer to identify the trade secret data. “This is a big deal,” according to Jeremy Sullivan, Manager of Competitive Intelligence & Analytics at DLA Piper… To my knowledge there is no other bulletproof resource for zeroing in on trade secrets litigation data.”

With the launch of its trade secret module, Lex Machina has uncovered some interesting insights within the data including:

- The Central District of California sees the most trade secret cases (7%), followed by the Southern District of New York (5%) and the District of Illinois (5%).

- Top law firms retained in trade secret cases include firms that specialize in labor and employment law, as many trade secret cases involve former employees.

- More than 1,350 cases with DTSA claims have been filed during the two years since it was enacted on May 11, 2016; only 11 of the 550+ currently active Article III district judges have evaluated DTSA claims on contested motions or presided over the issue at trial

- 71% of trade secret cases that resolve at trial are won by claimants whereas 29% are won by claim defendants

The Insights and Analytics

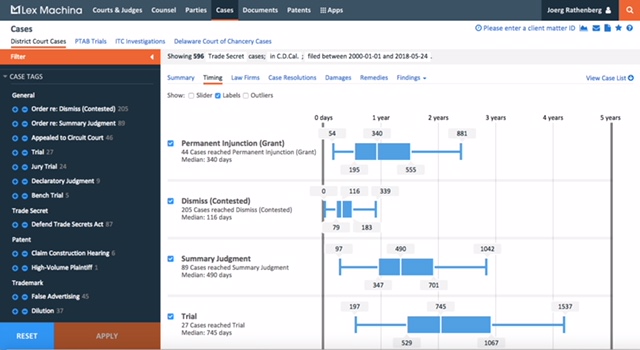

The trade secrets module will provide all the standard insights on judges, parties, law firm and courts which can be used for client pitches and litigation strategy. Case timing, motion metrics damages will include new tags which are specific to “trade secrets” issues.

Some of the new tags are:

- Case tag- Defend Trade Secrets Act

- Damages actual/lost profits, reasonable royalty, punitive/willfulness damages

- Finding- State Law Trade Secret Misappropriation (DTSA Trade Secret Misappropriation

- Other Findings: Ownership validity, Failure to identify trade secret, failure to maintain secrecy, readily ascertainable

- Defenses: Independent development

- Remedies: Granted and denied permanent injunction preliminary injunction and TRO

The Competition Given the increasing importance of trade secrets, it is surprising that there have been so few new products addressing this issue. Last year, following the enactment of the Defense of Trade, Wolters Kluwer released Trade Secrets Advisor which provides practical guidance as well as statutory and regulatory updates. Westlaw, Lexis and Bloomberg Law also provide general practice materials and treatises on trade secrets. Since Bloomberg recently announced the ability to allow customers to search complaints – their docket product could be tested for identifying “trade secret” complaints… as in.. You can find out something.. about trade secret litigation but not deep analytics.. So at this point , Bloomberg Law they may be the competitor most likely to develop analytics for trade secrets litigation based on today’s product landscape.

Trade Secret Webcast

For more information about Lex Machina’s newest practice area, please register here for the Legal Analytics for Trade Secret Litigation webcast (May 31, 11:00 PDT/2:00pm EDT). Lex Machina’s Owen Byrd and Rachel Bailey will discuss trends and insights for Trade Secret litigation in federal court, and give viewers a peek into Lex Machina’s new practice area capabilities.